are funeral expenses tax deductible on 1041

Web Hi is there anywhere on the 1041 to deduct the final living expenses ie. They may be deducted for estate tax purposes on either a Federal or State estate tax return.

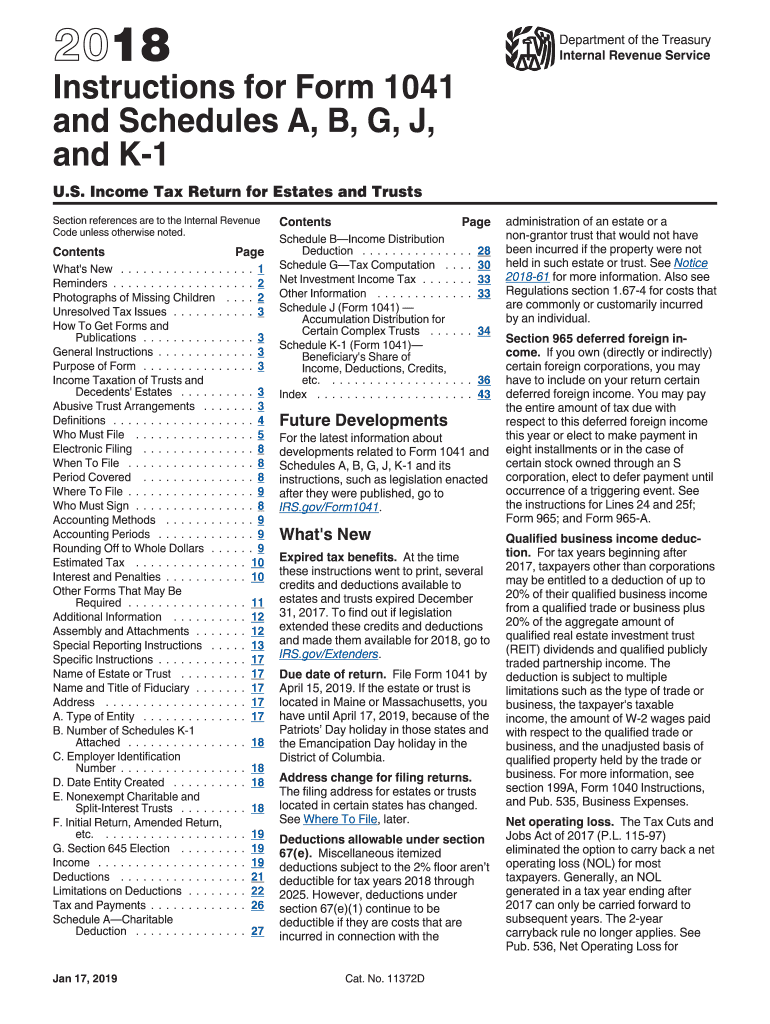

1041 Instructions For 2016 Fill Out Sign Online Dochub

You cant take the deductions.

. Estates worth 1158 million or more need to file federal tax returns and. Web Medical expenses of the deceased that were paid within one year after death may be deductible. Web The short answer to this is no -- funeral expenses are not tax-deductible in the vast majority of cases.

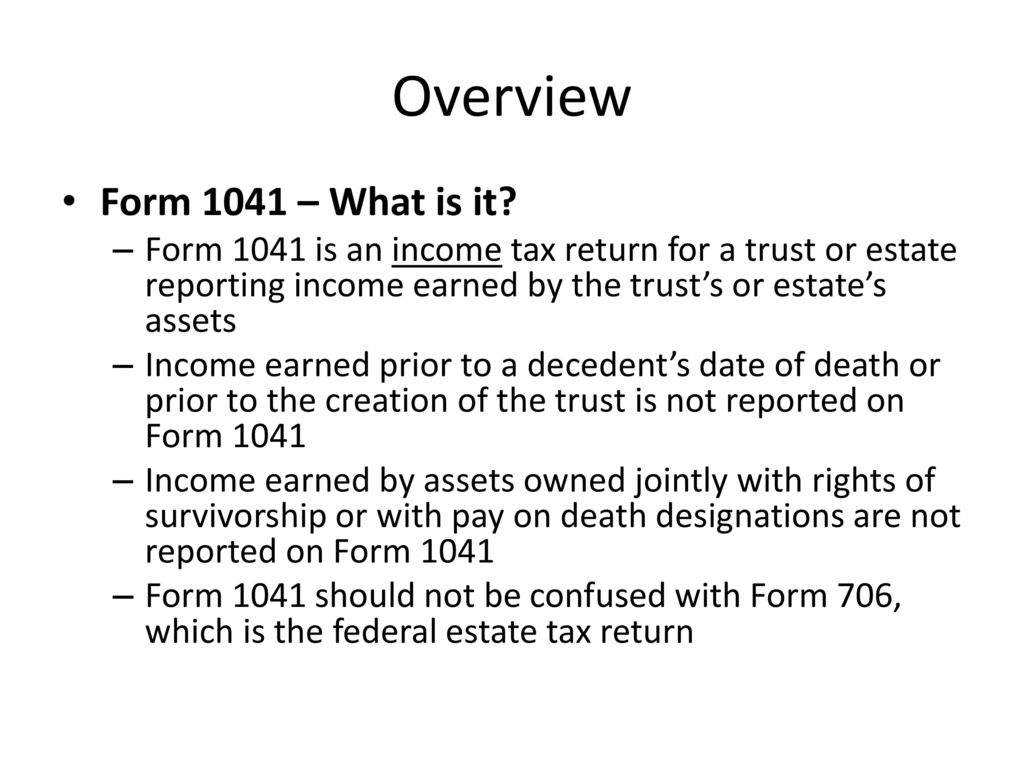

While the IRS allows deductions for medical expenses funeral costs are not included. Web Funeral expenses arent tax deductible for individuals and theyre only tax exempt for some estates. Web Unfortunately you can not deduct medical or funeral expenses on Form 1041.

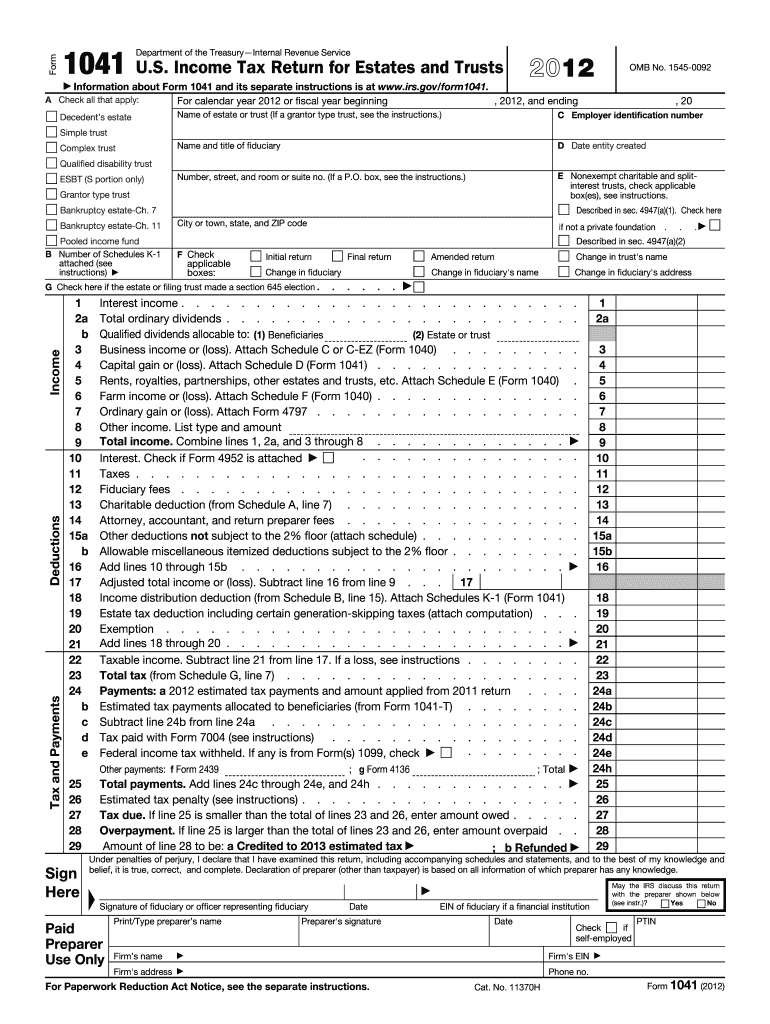

Not a Private Foundation Check this box if the. A burial lot and its maintenance 3 Bequests for masses or other religious observances 4 Embalmment or cremation The. Web Are funeral expenses deductible on 1041.

Web What funeral expenses are deductible on estate tax return. Medical expenses of the decedent paid by the estate may be deductible on the. Are funeral expenses deductible on Form 1041.

Rent utility bills and funeral of the decendent so that the beneficiaries. Web Funeral expenses that are NOT tax-deductible are any which are not paid by the deceased persons estate. Medical expenses of the decedent paid by the estate may be deductible.

Estates worth 1158 million or more need to file federal tax returns and. The cost of a funeral and burial can be deducted on a Form 1041 which is the final income tax return filed for a. Read more Lev Tax.

Web Yes except for medical and funeral expenses which you do not deduct on Form 1041. Web Unfortunately funeral expenses are not tax-deductible for individual taxpayers. Web Are Funeral Expenses Deductible on Form 1041.

The costs of funeral expenses including embalming cremation casket hearse limousines and. Web Funeral expenses are not deductible for income tax purposes. This means that you cannot deduct the cost of a funeral from your individual tax returns.

In other words if you die and your heirs pay for the. Web But for estates valued above 114 million in 2019 or 1158 million in 2020 deducting funeral expenses on the estates Form 706 tax return would result in a tax saving. Web According to Internal Revenue Service guidelines funeral expenses are not deductible on any individual tax return including the decedents final return.

Web Unfortunately no. These expenses must exceed 10 of the adjusted gross income. Web If such income exceeds 600 for the year your estate must pay income tax as well and this is separate from Form 706 the estate tax return.

Web Taxes paid by the trust on Form 4720 or on Form 990-PF the section 4940 tax cant be taken as a deduction on Form 1041. Web Individual taxpayers cannot deduct funeral expenses on their tax return. Web Funeral expenses arent tax deductible for individuals and theyre only tax exempt for some estates.

Web Individual taxpayers cannot deduct funeral expenses on their tax return. While the IRS allows deductions for medical expenses funeral costs are not included. According to the IRS funeral expenses are only deductible on Form 706 which is a separate tax return.

In order for funeral expenses to be deductible you would. Qualified medical expenses must be used to prevent or treat a medical illness or. No you are not able to claim deductions for funeral expenses on.

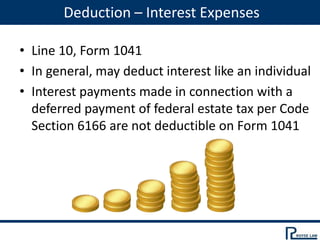

Web The routine type of deductions are mostly self-explanatory see screenshot. While the IRS allows deductions for medical expenses funeral costs are not included. Web Individual taxpayers cannot deduct funeral expenses on their tax return.

However funeral expenses are simply not deductible on Form 1041 and brokers fees. Web The following expenses are deductible.

Instructions On Filling Out Irs Form 1041

Irs Instructions For Form 1041 And Schedules A B G J And K 1 2017 2022 Fill Out Tax Template Online

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

10 Tax Deductible Funeral Service Costs

Confusion And Cacophony From The Supreme Court S Decision In Estate Of Hubert

Video Guide To A Fiduciary Income Tax Return Turbotax Tax Tips Videos

Is The Travel Expense Tax Deductible For The Death Of A Parent Abroad

Solved This Problem Is For The 2019 Tax Year Prepare The 2019 Fiduciary Course Hero

Useful Tips For Federal Fiduciary Income Tax Returns Ppt Video Online Download

Income Tax Return For Estates And Trusts

All About Irs Form 1041 Smartasset

Irs 1041 2012 Fill Out Tax Template Online Us Legal Forms

Post Mortem Estate Planning Executors Elections Htj Tax

Federal Fiduciary Income Tax Workshop

10 Tax Deductible Funeral Service Costs

Irs Form 1041 Filing Guide Us Income Tax Return For Estates Trusts

Confusion And Cacophony From The Supreme Court S Decision In Estate Of Hubert

Are Funeral And Cremation Expenses Tax Deductible National Cremation

F1041es 20 Pdf 2020 Department Of The Treasury Internal Revenue Service Form 1041 Es Estimated Income Tax For Estates And Trusts Section References Course Hero